VW STOCK SQUEEZE SERIES

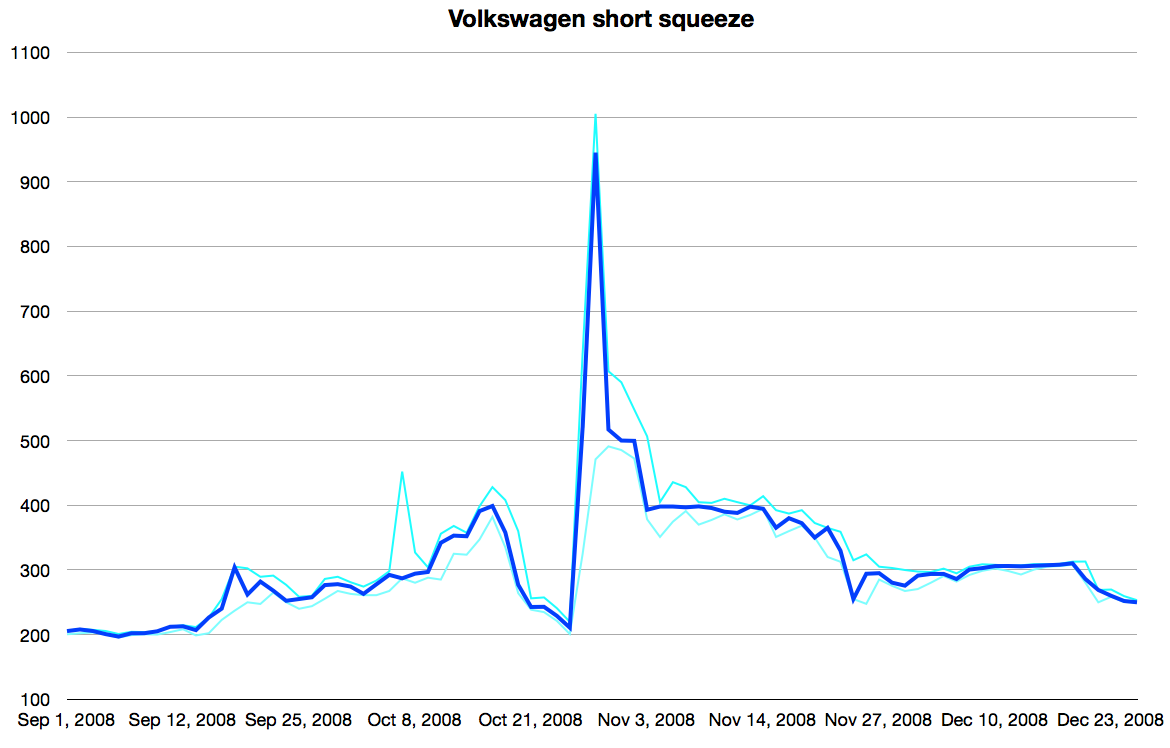

The biggest short squeeze in history occurred in 2008 when Porsche embarked on an unexpected series of maneuvers that left it controlling a huge. The rise in VW's value comes as other European carmakers are laying off workers and temporarily closing production lines to cope with a likely fall in sales of up to 20% next year. LAWRENCE A short squeeze happens in the market when investors bet against a stock that aggressively increases in price, causing these sellers to cut losses and exit their positions. The dealings in VW shares over the past few weeks have prompted the German market regulator BaFin to monitor price movements and it is now under pressure to mount a full-scale investigation. Porsche, which has made billions out of its transactions in VW options, saw its shares fall 14.5% during the day. In other words, VW’s ordinary stock was overvalued compared to its peers.

The consensus of analyst reports at the time suggested that the voting stock of VW was expected to decrease to EUR 140 per share or less in the foreseeable future. The Volkswagen short squeeze on 2728 October 2008 was unprecedented in propelling a car maker to become the worlds most valuable company by market. A short squeeze occurs when there is a lack of supply and an excess of demand for the stock due to short sellers having to buy stocks to cover their short. At one point VW shares leapt to €635 each. The Porsche-VW squeeze of October 2008 is therefore an interesting and important short squeeze to study. Porsche said it had raised its 35.2% holding to 42.6% and had options on a further 31.5%, giving it nominal control of 74.1%.Īs the federal state of Lower Saxony holds 20.2%, this reduces the free float shares to a rump of less than 6%.Īmid panic buying on the Frankfurt bourse, traders who had bet on VW stock plummeting because of evidence that the recession would hammer sales and profits, were forced to purchase shares to close their short positions.

0 kommentar(er)

0 kommentar(er)